With ACH payments, businesses can send and receive payments directly from their bank accounts. Compared to traditional payment methods like checks and credit cards, they offer a number of benefits to businesses of all sizes.

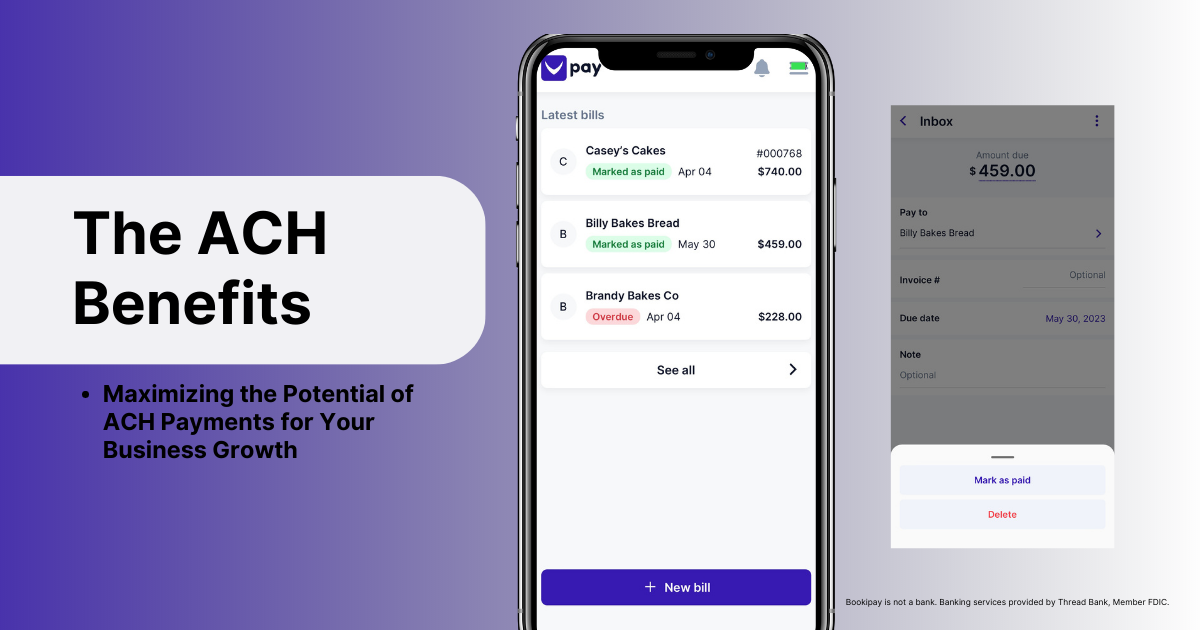

One powerful tool that can propel your business growth is ACH payments. Automated Clearing House (ACH) transfers offer a seamless and cost-effective way to process transactions, streamline operations, and enhance your financial management. The process of paying your bills is no longer a hassle.

Here are some of the benefits of ACH payments:

Cost-effective savings:

ACH payments are very cost-effective, as businesses can save money on processing fees.

Efficient and convenient:

ACH payments are processed quickly and reliably. (3-5 days clearing)

Cash flow management:

Use Bookipay to schedule bills and check when you have sufficient cash flow to pay larger bills.

Secure:

ACH payments are very secure, as they are processed through a secure network.

Easy to use:

ACH payments are easy to use for both businesses and customers.

ACH payments provide several key benefits that can fuel your growth. Firstly, they offer cost savings compared to other payment methods. With zero or minimal transaction fees, ACH transfers allow you to allocate more of your resources towards strategic initiatives, such as marketing campaigns or product development. This cost efficiency is especially beneficial for small businesses with limited budgets, enabling them to maximize their profitability.

ACH payments offer convenience and efficiency. By eliminating the need for manual check processing, businesses can save time and reduce administrative burdens. ACH transfers can be easily automated, ensuring that payments are made accurately and on time. This streamlined process not only frees up valuable resources but also minimizes the risk of human error, enhancing overall operational efficiency.

Another advantage of ACH payments is improved cash flow management. With faster access to funds, you can optimize your working capital and meet your financial obligations promptly. ACH transfers typically clear within 3-5 business days, allowing you to maintain a healthy cash flow and seize opportunities as they arise. Drive your business growth with a reliable, predictable payment method.

Your financial data is protected by ACH payments. ACH transfers are conducted through encrypted channels, reducing the risk of fraud or unauthorized access. By leveraging ACH payments, you can instill confidence in your customers, demonstrating your commitment to safeguarding their sensitive information.

Offering ACH transfers as a payment option can attract and retain customers, ultimately driving repeat business and increasing customer loyalty. By meeting your customers’ preferences, you can build stronger relationships and differentiate yourself in the market.

Ensure that your accounting systems and software are compatible with ACH processing to streamline your financial workflows.

Educate your customers about the benefits of ACH payments and promote this option as part of your payment offerings. Highlight the convenience, security, and cost savings that come with ACH transfers. By embracing this technology, you can position your business as forward-thinking and customer-centric, attracting tech-savvy customers and gaining a competitive edge.